APR for a Car Loan Explained

The car buying process is awash with acronyms, but APR, which stands for Annual Percentage Rate, is at the top of the list of terms to know. APR will significantly impact the overall cost of your car payments if you’re using a loan to purchase your vehicle.

Whether you’re buying new or used, it’s important to understand how the APR aspect of car financing works. Here’s what you need to know.

What is APR in relation to car loans, and why is it important?

APR vs. interest rate on an auto loan

When you take out a loan, you’re borrowing money to pay for something. Interest rates are the “cost” you pay to borrow that money. The interest rate on an auto loan is the cost of borrowing the principal loan amount each year, expressed as a percentage.

When purchasing a car, the Annual Percentage Rate includes the interest rate, but also additional fees, like application fees, loan origination fees, and, in some cases, credit insurance premiums. Like the interest rate, it is expressed as a percentage, but it is the total cost you will pay each year to borrow the money you used to buy the car.

Fixed vs. variable APR

There are two types of APR you might encounter: fixed and variable. A fixed APR remains constant throughout the life of the loan, providing stability and predictability in your payments. A variable APR can change over time, typically as market conditions change. While a variable rate might offer lower initial payments, it carries the risk of the rate (and your payments) increasing in the future.

Factors that influence APR

Even if you and someone you know bought the same exact car, the APR rate for the both of you likely won’t be the same. Why? When it comes to APR for a car loan, several factors can influence the rate you're offered:

- Credit Score: A higher credit score usually results in a lower APR.

- Loan Term: Shorter loan terms often have lower APRs but higher monthly payments.

- Type of Car: New cars often have lower APRs than used cars.

- Down Payment: A larger down payment can sometimes secure you a lower interest rate.

- Income and Expenses: Your debt-to-income ratio can also affect the APR you're offered.

Fees

Remember, lenders may charge a variety of fees in order to originate a loan. Such fees, sometimes called prepaid finance charges, may include:

- Loan origination and application fees: Loan origination fees cover the cost of processing the loan application, including paperwork, credit checks, and administrative tasks.

- Documentation and administrative fees: Similar to loan origination and application fees, documentation fees, sometimes called doc fees, cover additional paperwork and administrative tasks involved in finalizing the car loan agreement, such as title searches and verification of financial documents.

- Brokerage charges: Brokerage charges are fees paid to loan brokers who assist in finding suitable loan options.

- Insurance premiums: Insurance premiums, such as credit life insurance or guaranteed asset protection insurance (aka gap insurance), are additional costs that lenders may require borrowers to purchase.

Since there are a variety of potential fees involved, be sure to ask for an itemized breakdown of any APR offering for an exact picture of what you’re spending your money on.

How to calculate APR for a car loan

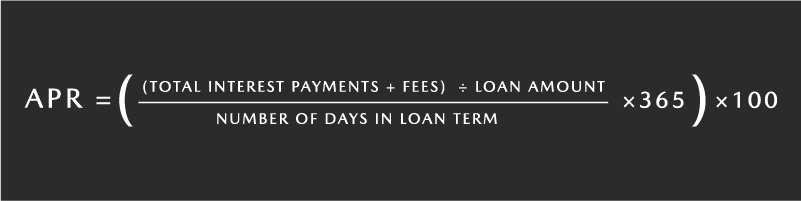

To calculate your APR, it’s easiest to use a reputable online APR calculator like the Mazda payment estimator, that can help you get an idea of what your APR and monthly payments might be. But if you’re up for some pen-and-paper math, then for a rough estimate, you can use the following APR formula:

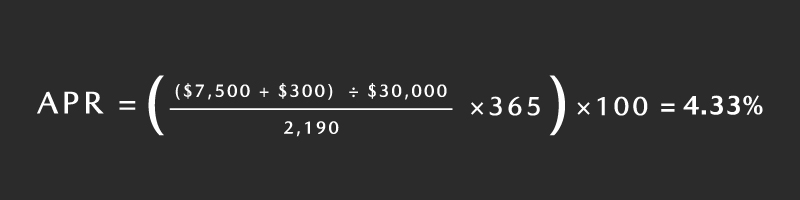

For example, if you were to settle on a car with a yearly interest payment of $7,500 plus $300 in fees, a loan amount of $30,000, and a loan term of 72 months, your APR would be roughly 4.33%.

What is a good APR for a car loan?

Generally, lower APRs are better, but what counts as a good APR varies from person to person, depending on individual financial situations.

You can gain a baseline understanding of what makes a great APR by looking at the average interest rates for new and used cars based on your credit score. For example, a report from CARFAX states that the average interest rate in the first quarter of 2024 for a new and used car was 5.38% and 6%, respectively, for someone with a credit score of more than 781. Meanwhile, the interest rate hikes up to 15.62% for a new car and 21.57% for a used car for someone with a credit score less than 500.

Again, keep in mind that what's considered a "good" APR for some might not be the same for you, so take the time to budget and find out what’s the best financial decision.

Average APR for a car loan

According to a report from Edmunds, the average APR for new vehicles in the first quarter of 2023 was 7%. Experts at Bankrate predict the average APR for new vehicles in 2024 to stay at 7% for 5-year car loans. However, while 7% serves as a benchmark, it's essential to approach financing with a personalized lens. Individual credit histories, incomes, and lending criteria will influence the APR you're offered. Moreover, as the market ebbs and flows, lenders adjust rates to reflect broader economic trends. So, when exploring financing options, it's crucial to research thoroughly, consult multiple lenders, and choose the one that aligns best with your unique financial situation.

Vehicle financing at Mazda

Here at Mazda, we’re ready to help you find your next car that not only fits your taste and budget but makes you feel alive. For help financing either a new or Certified Pre-Owned Mazda, you can head over to our online payment estimator and trade-in estimator to help gauge your expected APR and monthly payments.

We also encourage you to explore our build and price and vehicle comparison tools to find, customize, and price your next car. If you already know what car you want, simply request a quote online.

Want to speak with someone about your options? Connect with an experienced representative at your local Mazda Dealer to receive personalized guidance, explore available models firsthand, go on a test drive, and turn your Mazda dream car into a reality.

More Car-Buying Resources By Mazda:

This article is intended for general informational purposes only and is based on the latest competitive information available at the time of posting. Information herein is subject to change without notice and without Mazda incurring any obligations. Please review a variety of resources prior to making a purchasing decision. Visit Resource Center for more articles.