How Will Tariffs Affect Car Prices?

Key Takeaways:

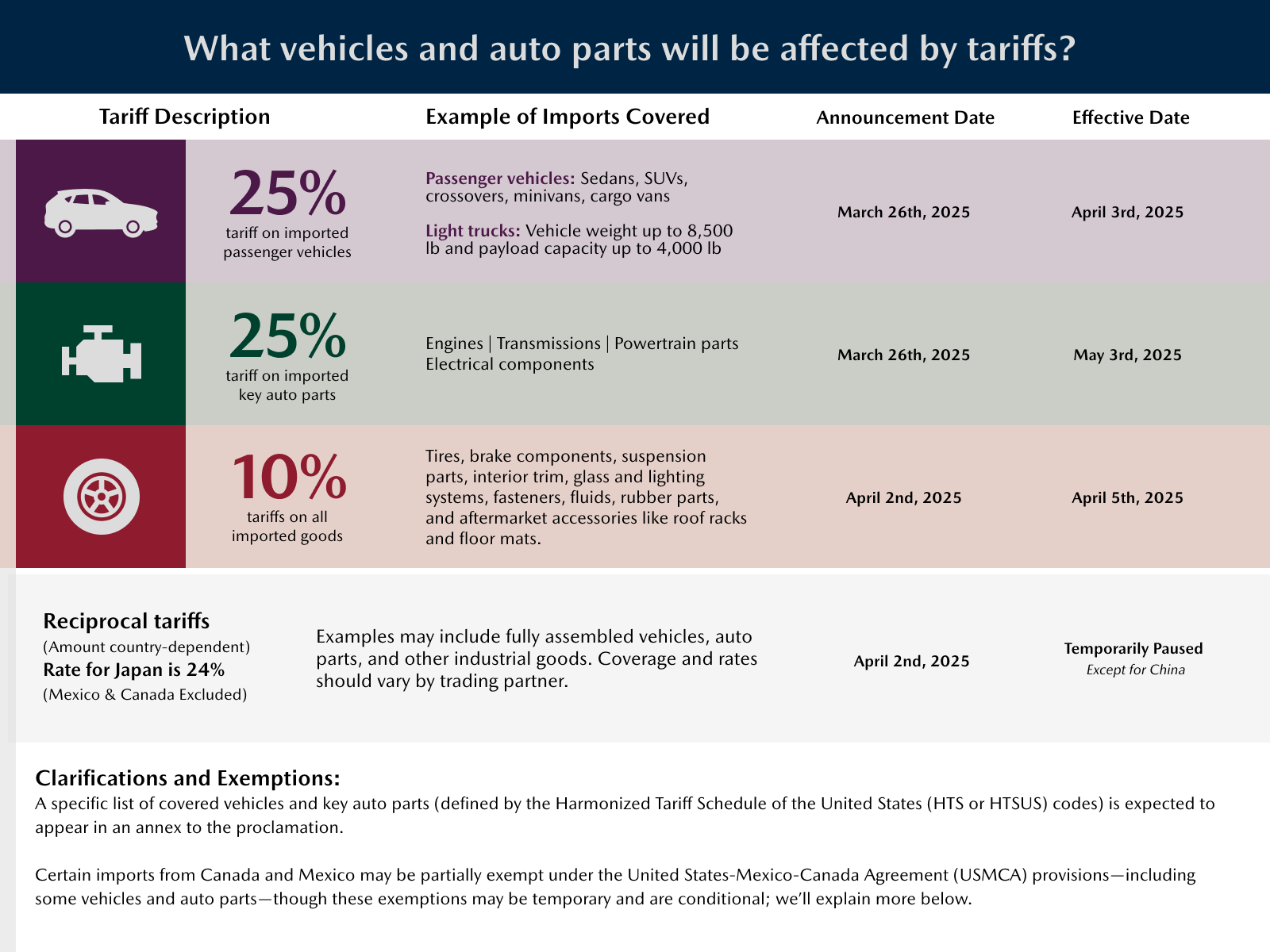

- New tariffs on vehicles and auto parts: The U.S. government has imposed a 25% tariff on imported vehicles and key auto parts, as well as reciprocal tariffs on many imported goods.

- USMCA exemptions: This is limited to the U.S. content of USMCA-compliant vehicles; any non-U.S. content is subject to a 25% tariff.

- Potential price increases: The tariffs are expected to raise prices for vehicles, with estimates ranging from $2,500 to $20,000 for some imported luxury models.

- Mazda pricing updates: While we explore the best way forward, vehicles currently in inventory at your local Mazda dealership are not impacted by these new tariffs.

The new tariffs on imported vehicles and auto parts are adding complexity to the car-buying process. Whether you're considering a new vehicle or just trying to stay informed, it’s important to understand the basics of these changes and how they might affect car prices.

Tariffs and trade policies can change quickly. While this guide reflects the latest information available at the time of publication, we encourage you to consult current news sources before making any final decisions.

A “Liberation Day” tariff timeline and overview

While some tariffs were previewed in late March, some details became clearer on April 2, 2025, when the U.S. government introduced the full “Liberation Day” tariff package. These left in place a 25% tariff on imported passenger vehicles, a 25% tariff on key auto parts (with some exceptions for USMCA-compliant vehicles and parts), and added reciprocal tariffs, many of which are essential to vehicle production.

Note: Reciprocal tariffs for most countries (besides China) have been temporarily paused for 90 days, as of April 9.

How does the U.S.-Mexico-Canada Agreement (USMCA) factor into these tariffs?

On March 4, 2025, the U.S. government announced a 25% tariff on imported passenger vehicles and key auto parts from Canada and Mexico. For USMCA-compliant vehicles, these tariffs only apply to the non-US content portion of the subject vehicle or parts.

Will the 10% and 25% tariffs stack?

No. The 25% imported passenger vehicle and key auto part tariffs will not stack with the 10% new reciprocal or baseline tariffs. Vehicle-related imports not covered under the 25% rate may instead fall under the 10% universal tariff if they’re not specifically included in the auto tariff list.

Will parts imported into the U.S. from Canada and Mexico for vehicles assembled in the U.S. be tariffed?

Yes, as of now. While the U.S. content of UMSCA-compliant parts imported into the U.S. for use in vehicle assembly is exempt from tariffs, the non-U.S. content is subject to the auto-specific 25% tariff. Parts imported from outside the USMCA zone (i.e., from countries outside of Canada and Mexico) are currently subject to the 25% auto-specific tariff.

This means that even if a vehicle is assembled in the U.S., the components coming from non-USMCA countries or that contain non-USMCA-compliant content will still carry additional costs.

How will these tariffs affect car prices and the auto industry?

The Anderson Economic Group estimates that the recent tariffs could increase costs by an additional $2,500 to $5,000 for the lowest-tariffed American-assembled cars, and up to $20,000 for some imported luxury models. The overall impact on U.S. consumers is projected to reach $30 billion in the first full year of the tariffs.

A vehicle’s final price depends on the origin of every one of its parts, and there is no such thing as a 100% U.S.-made vehicle. An engine alone can contain more than 1,000 individual parts, each of which requires materials that may be sourced from different countries than where they are manufactured, assembled into the engine, and ultimately installed into the vehicle. Simply put, every automaker will be uniquely affected by these tariffs, and how they adjust production and sourcing will also be unique.

How can I stay up-to-date on how these tariffs may impact Mazda?

While we’re still finalizing our long-term strategy in response to these tariffs, you can stay up-to-date about the latest at Mazda by visiting our vehicle lineup and special offers pages.

In the meantime, shoppers can currently find vehicles not impacted by these new tariffs at your local Mazda dealership.

This article is intended for general informational purposes only and is based on the latest competitive information available at the time of posting. Information herein is subject to change without notice and without Mazda incurring any obligations. Please review a variety of resources prior to making a purchasing decision. Visit Resource Center for more articles.